You want to invest sustainably and invest your money as socially and environmentally friendly as possible? Then you've come to the right place! Maybe you already eat vegan, avoid flights as much as possible, buy green electricity, buy seasonal, organic food and try everything else to reduce your carbon footprint. Making lifestyles more sustainable.

But it's not only important what you spend or save your hard-earned money on - it's also important where it's located. Under certain circumstances, your bank may invest your money in fossil fuels, for instance, which Factory farming or companies that violate human rights without you noticing. With a few tricks, however, you can quickly find out and fix this so that your money works sustainably for you, your values and your financial goals, as well as for the good of the world.

In this article, you will learn exactly what sustainable investing is and how it works. From the benefits, to industries, to investments and their characteristics, to tips for your sustainable investing. Let's go!

Here you can find a short overview in advance:

Good to know: I wrote this article in collaboration with Philip from kinu.earth written. As he deals with sustainable finance on a daily basis, he is naturally particularly knowledgeable in this area.

Definition: What is sustainable investing?

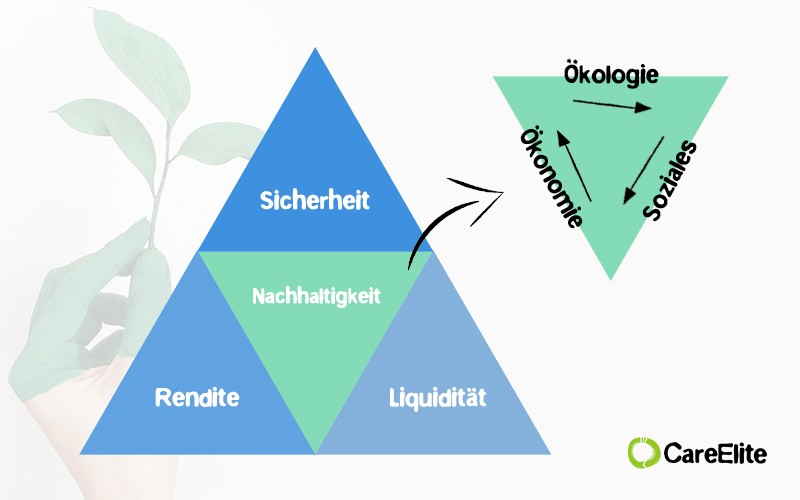

The classic "Magic Triangle of Asset Investment" with the competing goals of return, liquidity and security you may already know from a personal consultation at the bank. This becomes with the consciously lasting investment simply around the class of sustainability expanded. It therefore also includes ecological, economic and also social objectives. (ESG criteria)

Now to the definition! Sustainable investment (often also called sustainable finance or ESG investment) means investing in companies according to ecological, economic and social aspectswithout disregarding the classic investment objectives. The aim is, above all, for one's own capital to provide a combined added value for the environment, the economy and society while increasing.

Advantages: Why is sustainable investing important?

Basically, sustainable investing is important because your investments will be Do good and at the same time financial goals (e.g. retirement provision, major purchases in the future) and personal Fulfill dreams can.

Before I go into this two aspects, I would like to give you here first a Overview about the most common motives for environmentally conscious investors:

- Great potential for high profit in the long term

- Significant risk reduction of the investment

- Positive social and environmental impact

- Consistency with personal values and beliefs

- Higher, regulatory changes Attention to ESG factors.

- Great market and growth opportunities

- …

Ethical investing for a better world

If you have not yet looked into sustainable investments, it is highly likely that your money is currently invested in projects that do not necessarily correspond to your personal values. So first of all, there are the ethical and moral motives that make it worthwhile to take a closer look at your own investments.

The first step should be to create a sustainable bank because it invests your money with tenfold leverage₁ and so you have a significantly greater, sustainable impact generate.

For example, about $90 trillion in investments will be needed by 2030 to meet the goals of the Paris Agreement.₂ How cool would it be if you could do your part with your retirement savings and other investments while benefiting financially from the sustainability of those investments?

Investing for your financial goals

Of course, your financial goals are at least as important - otherwise you could just donate the money. If you just leave your money in the account or under the pillow, it loses value due to inflation. In the future, you can therefore afford less with the same money. Of course, this is problematic if you want to provide for your old age or save for larger expenses in the future.

But when you invest it, you benefit from a return. Depending on the type of investment, this varies and is associated with different risks. In the normal case, however, over a longer period of time quite certainly expected a return be achieved. For the German share index (DAX), for example, this averages 7 percent per year.₃

More importantly, the longer you have time and invest your money, the lower the risk and the greater the compound interest effect. So starting as early as possible is especially important when investing! Doing nothing with your own money leads to loss of value and probably also to your money supporting companies and that are bad for the environment and social development.

Forms: What types of investments should I know?

When investing (sustainably), experience has shown that one encounters many different forms and complex terms. I will try to bring some light into the darkness and briefly explain the most important types of investments. In the further course I will explain their sustainable effect and how you can invest in practice.

What is a share, a fund or an ETF?

The classic way of investing is to invest money in Shares on the stock exchange. These are (very small) shares in a company. You can either buy a share individually or bundled with other shares.

In the case of bundling, one then speaks of a Equity Funds. It is usually actively put together by people who check whether a company should be included in the fund or not. However, such funds can also be put together automatically according to fixed rules (e.g. the largest companies of a country or an industry), which then means ETF (Exchange Traded Fund, often also index fund) or passive fund.

The advantage of investing in shares, share funds and ETFs is that you can sell your shares at any time. The form of investment is therefore very flexible. With funds and ETFs, you also enjoy the advantage that you can easily invest in many companies at the same time simply by following your heart.

This diversification is essential for your Risk minimization particularly important: if a company performs poorly, this is compensated for by other companies in the index. An ETF also usually has a lot of lower feessince no managers have to be paid, as is the case with funds.

How can a share have a lasting effect?

If you buy an active, the company does not receive any money, because you buy it from another person or organization. Theoretically, however, the High demand for the shares of this company also their share price. And that means that the company can raise money more cheaply. In this way, your share already has an indirect sustainable effect.

But even better: through the share you also have a Voting rights and can thus influence the management of the company on a pro rata basis. When you buy individual shares, you can also transfer your voting rights at some companies, e.g. to the Umbrella Organization of Critical Shareholders, who then pushes for sustainability and ethics on your behalf.

Good to know: Active funds or ETF providers:inside sometimes use the voting rights of their shares, but unfortunately only very rarely very actively and in the sense of a sustainable transformation.

What is impact investing and crowdinvesting?

Impact investing has many definitions. In this article I mean Investments that provide measurable and obvious added value create. For example, you can contribute a small part to a wind farm or forest project, where it is clearly calculable how much CO2 is avoided or how big your personal impact is.

But real estate projects or young, sustainable companies can also be financed. Mostly you then invest together with many other (because of this Crowd Investing) over a fixed period and receive pre-agreed interest. This is very easy to do via various crowdfunding platforms, for example.

What is a call or time deposit or a savings bond?

At your bank, you may have heard of call money and time deposits. In both cases you save your money on a separate account. At Call money you can dispose of your money on a daily basis and usually receive a higher interest rate than on a checking account.

At Fixed Deposit In contrast, you invest your money for a fixed period of time and cannot dispose of the money during this time. The term usually varies between six months and several years. A Savings bond has the same principle and usually even longer terms of up to 10 years. On the other hand, fixed-term deposits or savings bonds pay a higher rate of interest than overnight deposits.

This form of investment is therefore very safe, but the expected return is usually lower than for equities or impact investing - often even below inflation.

What are bonds?

When states or companies (the issuer:s) need capital, they may issue securities in which you can invest. In exchange for the borrowed money the issuer or the issuer of the bond pays you a fixed interest rate and guarantees repayment of the principal at the end of the term.

Bonds have different maturities and interest rates, depending on the creditworthiness of the issuer and other factors. They are often referred to as safe investment as the repayment is guaranteed by the issuer.

Industries: Which business areas and practices are sustainable and which are not?

With every penny you entrust to a bank or other business, you're supporting them. That's why it's so important, Addressing who and what you support through your money.

So let's take a look at the business areas and practices that characterize both harmful and sustainable investments. They can ultimately help you choose the right offers on the financial market.

Ecology

Whether climate change, Plastic waste in the environment or Water shortage - we humans have the greatest environmental problems of our time created ourselves. Now we have to solve them together. By investing your money sustainably, you can become part of the solution. You can use the following aspects to guide your investment.

To promote in the spirit of sustainability:

- Renewable energies

- Energy efficiency and resource conservation

- Waste prevention (see Zero Waste Lifestyle)

- Water conservation

- Climate friendly nutrition (see Food & Environment)

- Organic farming

- …

To be avoided in the interest of sustainability:

- Deforestation of the rainforests

- Factory farming

- Genetic engineering

- Coal and nuclear energy

- Pollution

- …

Social

However, a sustainable investment should also take fair, social and societal aspects into account. Therefore, make sure that your investment promotes sustainable and ethical industries and excludes critical business sectors as far as possible.

To promote in the spirit of sustainability:

- Social facilities

- International cooperation

- Anti-animal (see Animal testing)

- Compliance with international conventions

- Equality between men and women

- Healthy, climate-friendly nutrition

- Anti-corruption

- Human Rights

- …

To be avoided in the interest of sustainability:

- Weapons industry

- Factory farming (see Factory farming)

- Porn industry

- Fur industry

- Alcohol Industry

- Tobacco industry

- Child labor

- Gambling

- …

Economics

If you decide to support a project, a medium-sized company, a bank or a corporation, you should also take a look at the company's management and its way of working.

To promote in the spirit of sustainability:

- Sustainable corporate philosophy

- Compliance with quality and environmental protection guidelines

- Combating corruption, child labor and the arms trade

- Transparency in reporting

- Fair working conditions

- Regional commitment

- …

To be avoided in the interest of sustainability:

- Corruption

- Arms trade

- Child labor (see Stop child labor)

- Tax evasion

- …

Characteristics: What makes an investment sustainable?

Unfortunately, the term "sustainable" is always Very subjective and complex. For example, are (large and heavy) electric cars environmentally friendly or not? And what about the companies that provide solar energy but buy raw materials from mining companies that violate human rights?

Since it is very difficult to evaluate such aspects transparently, there are more and more, especially in the financial sector Greenwashing. To give you a better overview, I would now like to introduce you to the most important concepts and distinguishing features of sustainable financial products.

Value-based and impact-oriented investing?

Before you invest your first cent sustainably, you should answer the question of whether you would rather invest value-oriented or impact-oriented. Here I would like to explain the two options to you first:

- Value-oriented: You bypass less sustainable companies or countries, but the direct, positive impact on the world and society is very small. This includes investing in shares via funds and ETFs or bonds, as well as overnight money or time deposits.

- Impact-oriented: here you invest with the aim of not only increasing the value of your money, but also influencing social and ecological factors and generating measurable added value for the world and society. Impact investing is therefore also a synonym for impact-oriented investment.

It's perfectly legitimate to start with slight cutbacks. After all, as already explained, the alternative "the money stays in the account" is usually no better.

Evaluation criteria ESG

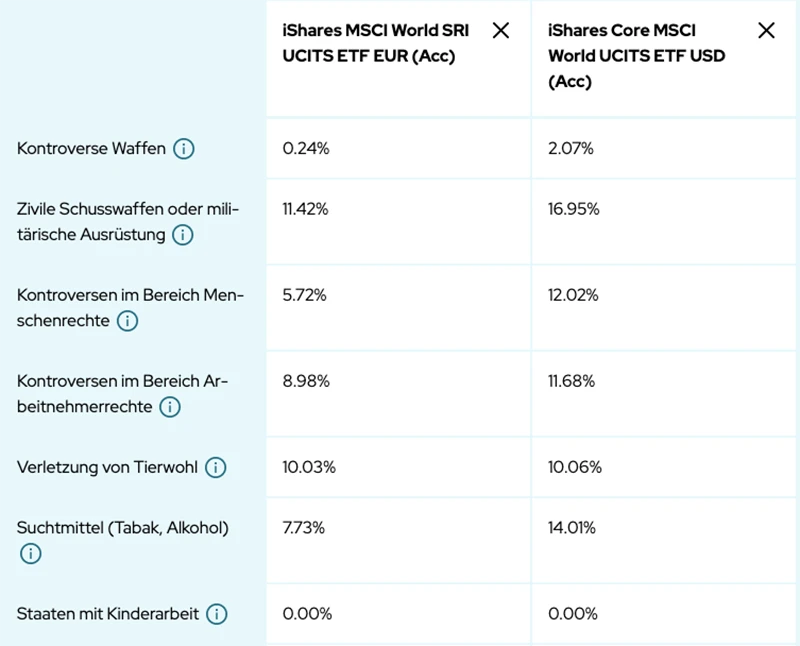

Many funds and ETFs are evaluated according to ESG criteria. ESG stands for Environmental, Social and Governance, i.e. the sub-areas of Environment, social affairs and corporate governance. It is important to note that this only assesses how great the company risk is to suffer financial loss in these areas. Not how good the social or environmental impact is in these areas. These criteria are mostly evaluated by rating agencies (rather non-transparent).

ESG funds or ETFs then usually include the most sustainable companies according to these ratings. Often also from each industry, so that, for example, the "most sustainable oil companies" are also represented.₄,₅

Article 8 and Article 9 Funds

These are funds that introduced by the European Union within the framework of the Disclosure Regulation have been. They invest in companies that meet high ESG criteria, while Article 9 funds invest exclusively in companies and projects that make a significant contribution to achieving the goals of the Paris Climate Agreement and have a clear and measurable positive impact on the environment.

In theory, this sounds great, but here, too, we are still at the beginning of a goal-oriented implementation. Article 8 in particular is No strict evaluationsince then about half of all funds would be "sustainable".₆

How do I find out if a fund, ETF is good or bad?

ESG, Article 8 and 9 - it all sounds pretty complicated, you might think. Fortunately, there are really great databases and trustworthy seals that help us environmentally conscious investors make our choice.

Seal for sustainable investments

There are an incredible number of seals (some of which are not so meaningful). The strictest on the German-speaking market is the FNG seal. The Forum Nachhaltige Geldanlagen (FNG) is an independent non-profit organization that promotes sustainable investments in Germany, Austria and Switzerland.₇ Also the Ecoreporter Seal is a trusted identifier for sustainable investments.

Due to the Variety of different investment types and fundsHowever, not all products can be checked. At this point, it is therefore advisable to additionally enlist the help of databases.

Helpful databases for sustainable investments

At MyFairWealth and Fair-Funds.info you can check funds, ETFs and individual companies, for example. Here you can clearly see what proportion of the companies are involved in controversial business according to ESG criteria. From palm oil or pesticides in the environmental area, to weapons or addictive substances in the social area, to corruption in the area of corporate governance.

Last but not least you can of course also FundWeb filter by article 8 and 9 and look at the largest companies in the fund or ETF. Perhaps there are companies there that you like particularly well or absolutely not at all.

Launch: What's the best investment for me?

First, it is important to give yourself a Save up a nest egg. This should cover up to six net monthly salaries.₈ You can use call money accounts at a sustainable bank for this purpose, for example. Finally, it is important that you invest your you do not need money invested in the market for a longer period of timeso that it can work for you, the environment and society.

This is an important basis of sustainable investing. What else you should pay attention to, I would now like to explain to you briefly and succinctly.

Determine criteria: Investment period, risk tolerance and hoped-for return.

The shorter you want to invest, the less risk you should take. For example, if you really want to use your money again in two years, but there is a financial crisis at that time, it would be annoying to have to sell the shares or ETFs at a loss. Over a longer time horizon, however, there is usually a positive trend - despite all the fluctuations. Especially if you invest continuously via a savings plan.₉

Often also makes quite a Mix of investment forms Sense. Call money for the nest egg, broadly diversified ETFs or bonds for a risk-minimizing retirement provision, and isolated impact investments with more risk for increased return opportunities and a positive impact.

How do I get started with sustainable investing?

You should first open your call money account at an eco-bank. For sustainable investments in shares, funds and ETFs, you can use the information portals mentioned above. You can then invest in the selected shares or ETFs with a securities account at your existing bank or one of our recommended providers. Low-cost securities accounts are offered, for example, by Trade Republic*, Scalable Capital and Smartbroker* an. Here you can start with a free savings plan and from as little as 10 euros a month.

Good alternatives to invest in sustainable shares are Inyova, the Tomorrow Better* Future Stocks or Evergreen*. They have a little more fees, but make a reasonable pre-selection for you.

For impact investing, there are great platforms like wiwin*, ecoligo (energy projects only), or also GLS Crowd. With these platforms you can binvest from 100 euros.

Your money can work for you and the good of the world at the same time

Not investing is also a decision - for loss of value and often negative effects on the world. So start now, even if you don't know everything yet and not everything works out perfectly. The providers and tips above will help you to find your individually suitable investment path.

For example, start with an ETF savings plan with a small monthly savings amount that you invest automatically with your securities account. Your task beforehand, however, is to register and get started before you can then sit back and relax.

"Wealth is good, when there is no guilt attached."

Jesus Sirach (more at Wealth Quotes)

I hope that I could help you with the tips from this post. Do you have any questions, suggestions or further advice? Then I look forward to your comment.

Stay sustainable,

PS: Many people believe that an environmentally friendly lifestyle is expensive. This is a big misconception! Why you actually save a lot of money through sustainability I'll explain how you can do this in the next blog article.

References:

₁ C. Siedenbiedel: Geldschöpfung - Wie kommt Geld in die Welt (Status: 05.02.2012), available at https://www.faz.net/aktuell/wirtschaft/wirtschaftswissen/geldschoepfung-wie-kommt-geld-in-die-welt-11637825-p2.html. [13.06.2023].

₂ G. G. Watkins, C. Contreras Casado, Z. Silva (2019): Attributes and Framework for Sustainable Infrastructure, available at https://publications.iadb.org/en/attributes-and-framework-sustainable-infrastructure. [13.06.2023].

₃ Deutsches Aktieninstitut e.V. 2022: Infographic "50 Years of Stock Returns - The DAX Return Triangle of Deutsches Aktieninstitut," available at https://www.dai.de/fileadmin/user_upload/211231_DAX-Rendite-Dreieck_50_Jahre_Web.pdf?ref=kinu-earth. [13.06.2023].

₄ P. Haberstock: ESG criteria, available at https://wirtschaftslexikon.gabler.de/definition/esg-kriterien-120056 [13.06.2023].

₅ S. Remer: Socially Responsible Investment (SRI), available at https://www.gabler-banklexikon.de/definition/socially-responsible-investment-sri-70774 [13.06.2023].

₆ Finanzen.net: Investing Sustainably with Article 8 and Article 9 Funds (as of Jan. 10, 20223), available at https://www.finanzen.net/ratgeber/unternehmen/artikel-8-fonds.html. [13.06.2023].

₇ Qualitätssicherungsgesellschaft Nachhaltiger Geldanlagen mbH: The criteria, available at https://fng-siegel.org/kriterien. [13.06.2023].

₈ Commerzbank AG: Investing a nest egg (as of October 24, 2022), available at https://www.commerzbank.de/sparen-anlegen/wissen/notgroschen-anlegen. [13.06.2023].

₉ ZEIT ONLINE GmbH: Time beats timing - Bei Aktien kommt es auf Anlagehorizont an (Stand: 25.01.2022), available at https://www.zeit.de/news/2022-01/25/bei-aktien-kommt-es-auf-anlagehorizont-an. [13.06.2023].